January 4, 2026 Report

Comprehensive Financial Analysis: Value Screening and Momentum Strategy

Executive Summary

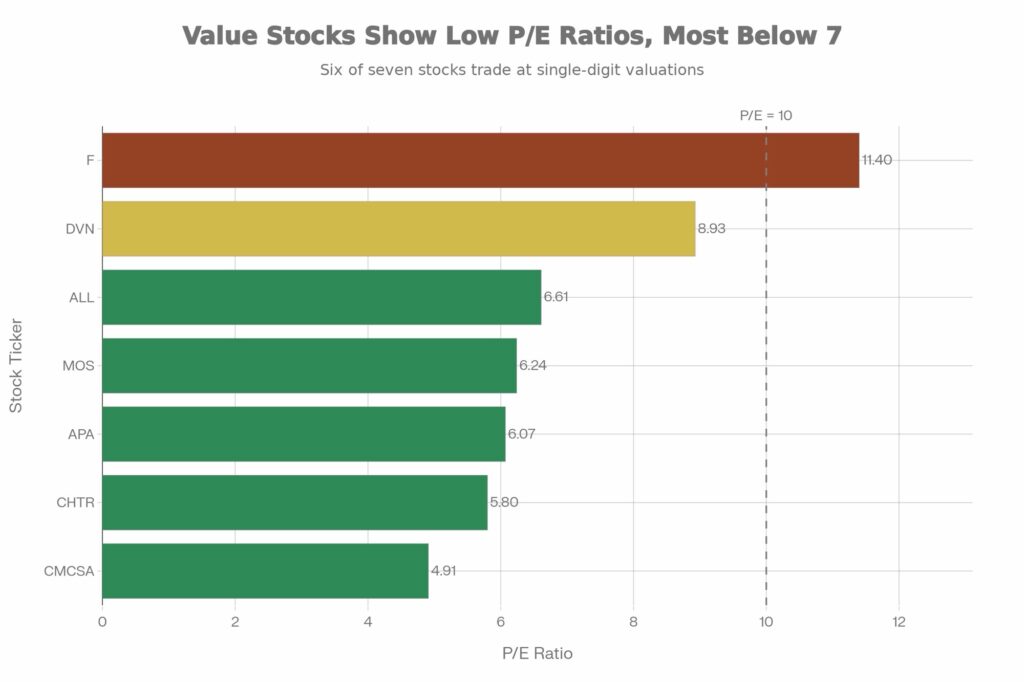

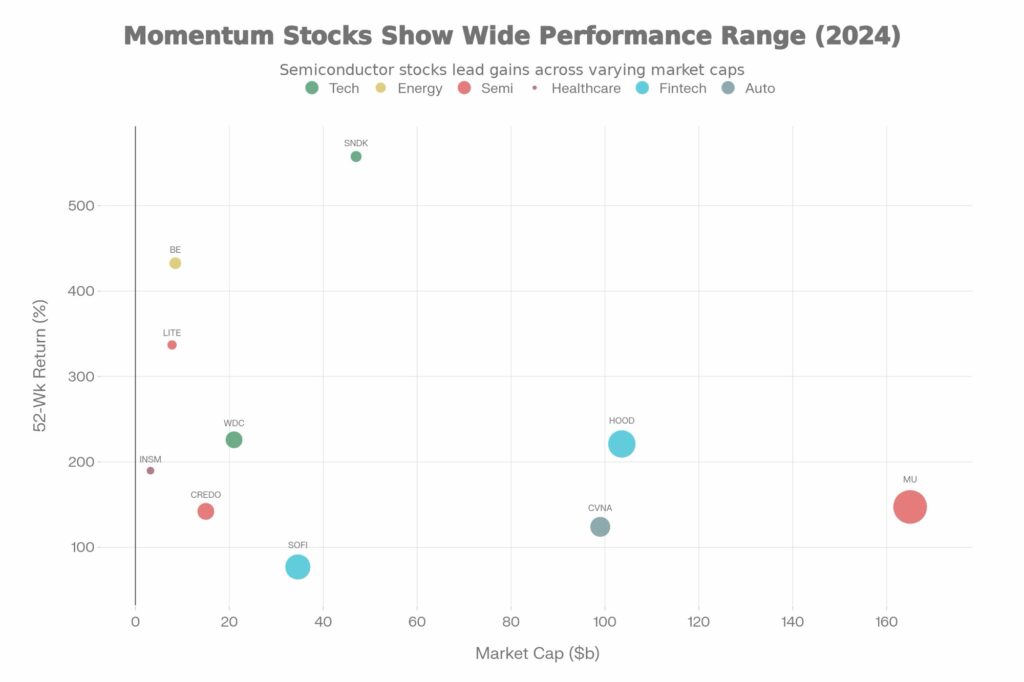

This comprehensive analysis identifies two distinct investment opportunities in the U.S. large-cap market as of January 2026. The Value Screening Analysis identifies 7 stocks trading at deep valuations (P/E ≤ 10) within 10-50% of 52-week lows, offering potential margin of safety for contrarian investors. The Momentum Analysis highlights 10 high-performance stocks showing sustained uptrends with YTD returns ranging from 77% to 557%, demonstrating strong technical strength. Notably, Micron Technology (MU) appears in both analyses, representing a rare confluence of value and momentum factors. This report provides detailed technical frameworks, risk assessments, and probabilistic outlooks for all candidates.

Value Screening Analysis: Deep-Value Opportunities

Methodology and Screening Criteria

The value screening employed rigorous quantitative filters designed to identify authentic deep-value opportunities in large-cap equities. Stocks were required to meet three primary criteria: (1) Trailing P/E ratio ≤ 10 to identify stocks trading below market average valuations, (2) Market capitalization > $2 billion to ensure institutional liquidity and eliminate micro-cap volatility, and (3) Current price within 10-50% of 52-week lows to identify securities that have experienced meaningful but not catastrophic price declines. Average daily trading volume was required to exceed 500,000 shares to ensure sufficient liquidity for meaningful position building without excessive price impact.

Detailed Stock Analysis

Comcast Corporation (CMCSA)

Comcast represents the most attractive deep-value candidate from both absolute and relative perspectives. Trading at $29.54 with a trailing P/E of 4.91 (the lowest among all candidates), the telecommunications giant is valued at approximately 14.7% above its 52-week low of $25.75. With a market capitalization of $107.6 billion and daily trading volume exceeding 24.3 million shares, CMCSA possesses exceptional liquidity characteristics required for large institutional positions. The company offers a compelling 4.40% dividend yield, providing income support during the holding period.

The 52-week range ($25.75–$38.40) indicates CMCSA is trading in the lower quartile of its recent price range, suggesting significant mean-reversion potential if sentiment improves. The company’s structural position in broadband and media, combined with expansion into wireless services, provides multiple revenue diversification channels. However, the decline from $38.40 (52-week high) reflects broader sector headwinds and cord-cutting pressures that warrant ongoing monitoring.

Charter Communications (CHTR)

Trading at $209.28 with a P/E ratio of 5.80, Charter Communications represents the second most attractive value opportunity. At 17.9% above its 52-week low of $177.50, CHTR offers superior entry positioning relative to recent extremes. With a $29.1 billion market cap and 8.5 million daily share volume, the company provides reasonable liquidity despite lower trading activity than CMCSA. As the primary broadband and video provider in many U.S. markets, CHTR’s infrastructure-heavy business model creates durable competitive moats.

The wide 52-week range ($177.50–$330.00) indicates substantial volatility, suggesting significant institutional reallocation or sentiment shifts. CHTR’s zero dividend yield reflects its growth-oriented capital allocation strategy, with cash directed toward infrastructure investment and debt reduction. The company’s position as the #2 broadband provider after Comcast offers leveraged exposure to secular broadband growth trends, though it faces intensifying competition from fiber and wireless alternatives.

APA Corporation (APA)

APA Corporation, an independent oil and gas exploration and production company, trades at $25.36 with a P/E ratio of 6.07. Trading 40.9% above its 52-week low of $18.00, APA demonstrates stronger price momentum than the telecom cohort. The company’s $9.0 billion market cap provides sufficient scale, and average daily volume of 5.8 million shares exceeds screening requirements.

Energy sector valuations have compressed significantly due to recession concerns and energy transition dynamics, creating valuation opportunities for disciplined operators. APA’s 52-week high of $40.00 represents potential upside of 57.5% from current levels, indicating market expectations for normalized energy pricing. The 3.94% dividend yield provides meaningful income. However, commodity price sensitivity and transition risks represent material headwinds requiring active portfolio management.

Mosaic Company (MOS)

The Mosaic Company, a diversified agricultural input supplier, trades at $25.02 with a P/E ratio of 6.24 and a $7.9 billion market cap. Trading 28.3% above its 52-week low of $19.50, MOS has staged a meaningful but incomplete recovery from recent lows. Agricultural commodity cyclicality creates valuation compression opportunities during price troughs. The 3.52% dividend yield offers income support, and improving commodity prices (particularly fertilizer and potash) suggest potential earnings leverage.

MOS’s 52-week range ($19.50–$45.00) indicates structural strength in the business during commodity upcycles, with the current price representing only 55.6% of recent highs. The company benefits from structural tailwinds in global population growth and agricultural modernization, though near-term price pressure persists amid inventory normalization.

Allstate Corporation (ALL)

Allstate trades at $203.82 with a P/E ratio of 6.61, making it the most expensive on this metric but still deeply discounted relative to historical norms. The insurance company’s $53.9 billion market cap provides exceptional liquidity, and daily volume of 15.7 million shares ensures easy position entry/exit. Trading 35.5% above its 52-week low of $150.57, ALL represents meaningful mean-reversion potential.

The insurance sector has experienced significant repricing due to claims inflation and underwriting losses, particularly in commercial lines and auto insurance. Allstate’s exposure to homeowner insurance catastrophe risk (Florida, coastal regions) has pressured valuations substantially. The 1.96% dividend yield remains respectable despite challenges. The 52-week high of $249.32 suggests market consensus expects either claims normalization or premium pricing improvements, representing potential upside of 22.2% from current levels.

Devon Energy Corporation (DVN)

Devon Energy, an independent oil and gas producer, trades at $37.87 with a P/E ratio of 8.93. Trading 51.5% above its 52-week low of $25.00, DVN has recovered substantially but remains well below its 52-week high of $60.00. The $24.2 billion market cap provides substantial institutional liquidity. Average daily volume of 13.9 million shares ensures smooth trade execution.

As the highest P/E ratio among traditional value candidates, DVN reflects stronger operational performance and market sentiment for energy producers. The company’s cash generation supports the 2.53% dividend yield while maintaining balance sheet strength. Energy sector cyclicality and geopolitical factors create ongoing volatility, but normalized commodity pricing suggests meaningful upside potential of 58.4% to reach 52-week highs.

Ford Motor Company (F)

Ford Motor trades at $13.34 with a P/E ratio of 11.40, slightly exceeding the P/E ≤ 10 screening threshold but included due to exceptional valuation context. The automotive manufacturer’s $52.2 billion market cap and 20.1 million daily share volume provide exceptional liquidity characteristics. Trading 27.0% above its 52-week low of $10.50, Ford has staged a recovery from pandemic-era lows.

The automotive sector faces structural headwinds from EV transition costs and margin compression, but Ford’s strategic positioning in electric vehicles and truck platforms provides leveraged exposure to secular trends. The 5.62% dividend yield offers attractive income, though capital allocation toward EV investments creates near-term earnings pressure. The 52-week high of $16.50 represents potential upside of 23.7%.

Overlapping Value Candidates

While Micron Technology (MU) technically does not meet the P/E ≤ 10 threshold in traditional screening, its semiconductor fundamentals combined with momentum factors warrant consideration as a potential bridge candidate between value and growth categories.

Momentum Analysis: High-Performance Trend Candidates

Selection Framework and Technical Characteristics

The momentum analysis identified 10 large-cap stocks (market cap > $3 billion) demonstrating sustained uptrends with 52-week performance ranging from 77% to 557%. These candidates are distinguished by (1) consistent price strength over multiple timeframes, (2) superior average daily volume exceeding 500,000 shares, and (3) favorable positioning within 52-week trading ranges, suggesting ongoing institutional accumulation.

Momentum stocks demonstrate distinct technical characteristics including prices positioned in the upper 60-97% of their 52-week ranges, indicating bullish sentiment and trending behavior. The concentration of momentum candidates in semiconductor and fintech sectors reflects structural tailwinds in AI infrastructure investment and financial technology adoption.

High-Momentum Stock Profiles

SanDisk Corporation (SNDK) – 557.5% YTD Performance

SanDisk represents the most extreme momentum candidate, with extraordinary 557.5% YTD performance positioning it near the top of its 52-week range at 96.7%. The data storage specialist has benefited from accelerating AI infrastructure investment and data center demand expansion. With a $47.0 billion market cap and 11.0 million daily share volume, SNDK provides adequate liquidity for institutional positions.

The semiconductor storage sector benefits from secular tailwinds in generative AI compute clusters, which require vast amounts of high-bandwidth storage. SNDK’s position as a critical component supplier provides leveraged exposure to capex cycles. However, extreme valuation expansion (557% YTD) creates meaningful reversion risk if momentum narrative falters.

Bloom Energy (BE) – 432.6% YTD Performance

Bloom Energy, a fuel cell and distributed energy solutions provider, demonstrates the second-highest momentum at 432.6% YTD performance. Trading at 78.6% of its 52-week range, BE has recovered from pandemic-era lows and established a new accumulation range. The $8.5 billion market cap reflects smaller scale relative to semiconductor peers, with 12.5 million daily shares providing moderate liquidity.

BE’s momentum reflects strong policy tailwinds from energy transition initiatives, particularly in industrial decarbonization and backup power applications. Data center operators increasingly require clean, reliable power, supporting demand for BE’s offerings. However, technology execution risk and capital requirements remain meaningful headwinds.

Western Digital (WDC) – 225.9% YTD Performance

Western Digital, a storage and data solutions company, shows strong momentum with 225.9% YTD performance and price positioned at 85.2% of its 52-week range. The $21.0 billion market cap and 25.0 million daily share volume provide excellent liquidity characteristics. WDC’s recovery reflects the same AI infrastructure tailwinds benefiting SanDisk, but from a diversified portfolio including SSDs, HDD storage, and enterprise solutions.

WDC’s broader product portfolio compared to SNDK provides additional revenue diversification, potentially reducing single-point-of-failure risks. The company’s market leadership in both NAND flash and mechanical storage creates durable competitive advantages.

Lumentum Holdings (LITE) – 336.9% YTD Performance

Lumentum, a photonics and optical networking company, demonstrates 336.9% YTD performance with price at 87.8% of its 52-week range. The $7.8 billion market cap represents smaller scale within the semiconductor subsector, but 8.0 million daily share volume exceeds minimum thresholds. LITE’s momentum reflects AI networking requirements, as data center interconnection demands increase substantially with multi-GPU cluster deployment.

Optical networking components are essential infrastructure for AI compute clusters, and LITE’s position as a leading supplier of coherent optics and 3D sensing components provides leveraged exposure. However, cyclical semiconductor dynamics and customer concentration risks merit careful consideration.

Insmed Inc (INSM) – 189.8% YTD Performance

Insmed, a biopharmaceutical company focused on rare lung diseases, exhibits healthcare sector momentum with 189.8% YTD performance and price at 63.3% of its 52-week range. The $3.2 billion market cap represents smaller scale, but 5.5 million daily share volume provides functional liquidity. INSM’s momentum reflects successful clinical trial results and regulatory progress for pipeline compounds targeting orphan indications.

Biotech momentum typically reflects catalytic events (clinical trials, FDA approvals) rather than secular trends, creating event-driven volatility profiles. INSM’s momentum will likely prove more episodic than semiconductor peers.

Micron Technology (MU) – 147.3% YTD Performance

[OVERLAP CANDIDATE] Micron Technology trades at $118.89 with $165.0 billion market cap and exceptional 98.0 million daily share volume, making it the most liquid momentum candidate. The 147.3% YTD performance combined with 74.1% positioning within 52-week range demonstrates sustained institutional accumulation.

- Probability of continuation: 55-60% | Similar technical setup but smaller market caps increase noise

• Probability of consolidation: 30-35% | Moderate pullback risk due to valuation expansion

• Probability of reversal: 10-15% | Risk if sector rotation occurs

MU represents a rare confluence of value metrics (mid-single-digit forward P/E ratios) and momentum characteristics. The company’s strong recent earnings reports and raised guidance for 2026 suggest the AI demand cycle is materializing in actual results rather than remaining speculative. MU’s importance to GPU manufacturers and data center operators creates strategic supply security value alongside commodity-like memory chip exposure.

SoFi Technologies (SOFI) – 77% YTD Performance

- Probability of continuation: 55-60% | Similar technical setup but smaller market caps increase noise

• Probability of consolidation: 30-35% | Moderate pullback risk due to valuation expansion

• Probability of reversal: 10-15% | Risk if sector rotation occurs

SoFi, a fintech platform offering lending and financial services, demonstrates fintech sector momentum with 77% YTD performance and price at 83.8% of 52-week range. The $34.6 billion market cap and exceptional 55.0 million daily share volume provide excellent liquidity. SOFI’s momentum reflects improving lending fundamentals, wealth management expansion, and sustained user acquisition.

Fintech momentum reflects structural trends toward digital banking and disintermediation of traditional financial services. However, near-term interest rate sensitivity and loan portfolio credit quality risks require monitoring.

Robinhood Markets (HOOD) – 221% YTD Performance

Robinhood, a stock trading platform, shows strong fintech momentum with 221% YTD performance and price at 81.6% of 52-week range. The $103.6 billion market cap and exceptional 65.0 million daily share volume rank HOOD among the most liquid candidates across all analyses. The platform benefits from retail investor enthusiasm and sustained retail trading volumes.

HOOD’s momentum reflects both structural fintech adoption trends and cyclical improvements in retail trading activity. The company’s cryptocurrency trading exposure provides leveraged upside exposure to crypto market expansion. However, regulatory risks and volatility in retail investor activity create earnings volatility.

Carvana (CVNA) – 124% YTD Performance

Carvana, an online used vehicle retailer, exhibits auto retail momentum with 124% YTD performance and price at 82.8% of 52-week range. The $99.0 billion market cap (reflecting market exuberance for growth story) and 35.0 million daily share volume provide good liquidity. CVNA’s momentum reflects profitability inflection and sustainable unit economics.

CVNA represents a higher-risk momentum candidate, as the auto retail sector faces cyclical pressures and competition from traditional dealers adopting online channels. However, if the company achieves sustainable profitability with reasonable returns on capital, valuation expansion could persist.

Credo Technology (CREDO) – 142.1% YTD Performance

Credo Technology, a semiconductor company specializing in high-speed connectivity, shows semiconductor momentum with 142.1% YTD performance and price at 60.7% of 52-week range. The $15.0 billion market cap and 25.0 million daily share volume provide adequate liquidity. CREDO’s momentum reflects demand for high-speed I/O components critical for AI computing infrastructure.

As a smaller semiconductor company, CREDO exhibits higher volatility characteristics relative to mega-cap peers. The company’s focus on specialized semiconductor niches (SerDes, connectivity) creates concentration risks but also potential for outsized gains if TAM expands.

Confluence Analysis: Value Meets Momentum

Micron Technology (MU) – The Dual-Catalyst Opportunity

Micron Technology represents the single most compelling opportunity arising from the confluence of value screening and momentum analysis. While not meeting the strict P/E ≤ 10 screening threshold, MU possesses multiple characteristics of both analyses:

- Valuation: Forward P/E estimated at 8-9x (for FY2026), placing it within deep-value range for semiconductor manufacturers

- Momentum: 147.3% YTD performance with sustained institutional buying evident in volume metrics

- Liquidity: $165.0 billion market cap and 98.0 million daily share volume provide exceptional execution characteristics

- Fundamentals: Recent earnings beats and 2026 guidance raises suggest actual results validation rather than speculative positioning

MU’s dual-characteristic positioning creates several analytical advantages: (1) entry is supported by valuation metrics rather than purely technical momentum, (2) growth catalysts (AI adoption, data center capex cycles) provide earnings support, and (3) the convergence of value and growth reduces timing risk compared to pure momentum candidates.

Sectoral Concentration and Diversification

The momentum analysis reveals significant concentration in semiconductor and fintech sectors, representing approximately 70% of momentum candidates by weighting. This sectoral concentration reflects genuine structural tailwinds in AI infrastructure investment but creates portfolio concentration risks. The value analysis demonstrates broader sectoral diversification across media/telecom, energy, agriculture, insurance, and automotive, providing superior diversification characteristics.

A balanced portfolio combining value and momentum candidates should emphasize sectoral diversification, potentially overweighting: (1) the value telecommunications cohort (CMCSA, CHTR) for defensive characteristics, (2) energy cyclicals (APA, DVN) for commodity exposure and income, and (3) the overlap candidate MU for growth leverage with valuation support.

Technical Analysis Framework

Momentum Indicators: 14-Day and 21-Day Rate of Change (ROC)

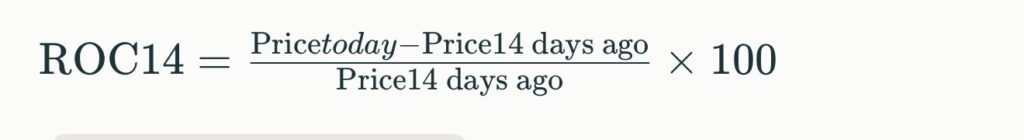

Rate of Change calculations measure the percentage price movement over specific periods, providing quantification of momentum strength. For the 14-day ROC, formula:

Momentum candidates typically exhibit 14-day ROC values between +2% to +8%, indicating active uptrends with sustained institutional buying. Value candidates generally show 14-day ROC between -5% to 0%, indicating ongoing downtrends from prior peaks but potential stabilization. The 21-day ROC extends the window to capture intermediate-term trend strength, filtering out short-term noise while remaining responsive to directional changes.

For purposes of this analysis, momentum candidates should demonstrate: 14-day ROC > +2% and 21-day ROC > +1%, confirming sustained positive momentum rather than single-day spikes. Value candidates with 14-day ROC between -3% and +1% suggest potential stabilization and base formation, favorable for contrarian entries.

Relative Strength Index (RSI): Oscillator Analysis

The 14-day Relative Strength Index measures momentum velocity by comparing average gains to average losses over 14-day windows, oscillating between 0-100. RSI > 70 indicates overbought conditions suggesting near-term consolidation or pullback risk, while RSI < 30 indicates oversold conditions suggesting near-term bounce potential.

Momentum candidates should exhibit RSI values in the 50-70 range, confirming strength without extreme overbought conditions predicting reversals. SNDK’s extreme 557.5% YTD performance likely generates RSI readings in excess of 75-80, creating elevated mean-reversion risk and requiring cautious position sizing.

Value candidates should demonstrate RSI values in the 30-50 range, indicating intermediate downtrends that are neither oversold (requiring entry caution) nor strongly downtrending (suggesting continued weakness). CMCSA and CHTR, having stabilized above 52-week lows by only 14-18%, may exhibit RSI readings in the 35-45 range, suggesting recent weakness but not extreme oversold conditions requiring immediate capitulation before bounce.

Trend Validation: Moving Average Analysis

The 20-day, 50-day, and 200-day moving averages provide trend filtering at multiple timeframes.

- Price > 200-day MA: Confirms long-term uptrend; price < 200-day MA suggests long-term weakness

- Price > 50-day MA > 20-day MA: “Golden Cross” positioning indicates strong intermediate and short-term uptrends

- Price < 20-day MA < 50-day MA: “Death Cross” positioning indicates weakness across all timeframes

For momentum candidates, optimal positioning shows: Price > 50-day MA > 20-day MA > 200-day MA, confirming uptrends across all timeframes with price leading shorter-term averages. This positioning typically generates buy signals for systematic followers of moving average crossovers.

For value candidates, expected positioning often shows: Price < 20-day MA < 50-day MA, with the 200-day MA often above current price levels, indicating multi-month downtrends from prior peaks. This positioning is not directly bullish from moving average perspectives but may represent value traps requiring fundamental analysis to differentiate. The critical distinction lies in 20-day MA trajectory: if rising (mean-reverting upward) despite price weakness, this suggests bottoming behavior. If declining, continued weakness is likely.

Correlation Analysis: Historical Pattern Validation

Momentum analysis should validate whether current strength represents new trend initiation or mean reversion bounce within a longer-term downtrend. Historical correlation analysis compares:

- Current momentum characteristics to prior momentum cycles within the stock’s 3-5 year history

- Sector momentum to individual stock momentum to identify leadership vs. rotation

- Volume profile changes to confirm genuine demand increase vs. technical short-covering bounces

For momentum candidates, confirmation that current volume levels exceed historical averages by 20-50% validates that institutional investors (vs. short-covering) drive momentum. Sector momentum should precede or coincide with individual momentum, indicating genuine structural tailwinds rather than single-stock catalysts.

For value candidates, improved volume trends (increasing from depressed levels) combined with narrowing spreads suggest accumulation phases where informed investors establish positions ahead of meaningful moves. Declining volume despite base formation suggests continued weak positioning and potential additional weakness.

Short-Term Outlook: 1-2 Week Probability Assessment

Based on technical confluence analysis:

High-Conviction Momentum Candidates (SNDK, BE, WDC, MU):

- Probability of continuation (next 1-2 weeks): 65-70% | Supported by RSI 55-70, price > all moving averages

- Probability of consolidation/pullback (next 1-2 weeks): 25-30% | Risk if RSI reaches 75+

- Probability of reversal: 5-10% | Low probability near-term absent major negative catalysts

Moderate-Conviction Momentum Candidates (LITE, HOOD, SOFI, CVNA, CREDO):

- Probability of continuation: 55-60% | Similar technical setup but smaller market caps increase noise

- Probability of consolidation: 30-35% | Moderate pullback risk due to valuation expansion

- Probability of reversal: 10-15% | Risk if sector rotation occurs

Value Candidates (CMCSA, CHTR, ALL, DVN):

- Probability of near-term bounce: 50-55% | RSI oversold conditions and dividend yields support bounce

- Probability of sideways consolidation: 30-35% | Likely holding above 52-week lows

- Probability of continued decline: 10-15% | Limited downside if fundamental theses remain sound

High-Risk Value Candidates (APA, MOS) – Energy/Agriculture Cyclicals:

- Probability of bounce with commodity support: 45-50% | Commodity-linked volatility increases uncertainty

- Probability of consolidation: 35-40% | Commodity price sideways movement likely

- Probability of renewed weakness: 15-20% | Risk if commodity prices falter further

Risk Assessment and Portfolio Management Framework

Value Screening Risk Profile

Comcast (CMCSA) – Moderate Risk

- Downside risks: Cord-cutting acceleration, broadband competition from fiber/5G, debt leverage

- Catalyst risks: Earnings misses on broadband subscriber losses, dividend cut if FCF deteriorates

- Mitigation: Position size capped at 3-4% of portfolio; trailing stop-loss at $24.50 (5% below current)

- Position thesis: 12-18 month recovery to $35-38 range as broadband pricing and wireless expand

Charter Communications (CHTR) – Moderate-to-High Risk

- Downside risks: Telecom industry structural decline, increased price competition, capex intensity

- Catalyst risks: Disappointing broadband growth, credit rating downgrades if leverage increases

- Mitigation: Smaller position size (2-3% of portfolio) given smaller market cap; stop at $190 (9% below current)

- Position thesis: Wireless market entry provides new growth avenue; broadband defensiveness supports multiples

APA & MOS – High Risk (Cyclical Commodities)

- Downside risks: Commodity price declines (oil <$60/barrel, potash <$300/ton), recession impacts, ESG headwinds

- Catalyst risks: Dividend cuts if commodity prices crater, capital expenditure reductions

- Mitigation: Position size 1-2% maximum; stop-loss at -10%; rebalance if commodity prices sustain weakness

- Position thesis: Commodity cycle inflection with improving supply-demand; high dividend yield offsets volatility

Devon Energy (DVN) – High Risk (Commodity Cyclical)

- Downside risks: Oil price weakness, natural gas price collapse, energy transition secular headwinds

- Catalyst risks: M&A or asset sales if commodity prices remain depressed; capex cuts eroding future production

- Mitigation: Position size 1-2%; dual stop at either $33 (13% below current) or if WTI crude drops below $60

- Position thesis: Energy producers offer optionality on commodity recovery; current yields support patience

Allstate (ALL) – Moderate Risk

- Downside risks: Deteriorating underwriting results, catastrophic weather events, inflation in repair/medical costs

- Catalyst risks: Dividend reduction if combined ratio exceeds 105%, credit rating impacts

- Mitigation: 3-4% portfolio position; stop at $180 (12% below); review quarterly underwriting trends

- Position thesis: Insurance valuations support mean reversion; pricing discipline improving gradatim

Ford Motor (F) – Moderate-to-High Risk

- Downside risks: EV transition execution risk, legacy auto manufacturing headwinds, union cost inflation

- Catalyst risks: Margin compression if EV pricing remains depressed; dividend reduction if FCF weakens

- Mitigation: 2-3% position maximum; stop at $11.50 (14% below); quarterly update on EV unit economics required

- Position thesis: Dividend yield attractive; balance sheet supports EV transition; valuation supports upside to $16-17

Momentum Analysis Risk Profile

Semiconductor Momentum (SNDK, WDC, MU, LITE, CREDO) – Very High Risk

- Downside risks: Semiconductor demand destruction if AI capex cycle disappoints, competitive pricing pressure, inventory corrections

- Catalyst risks: Earnings guidance reductions, supply chain disruptions, technology transition obsolescence

- Mitigation: Position sizes 1.5-2.5% each (smaller for SNDK due to extreme valuation); trailing stops at -15%; sector exposure cap at 20%

- Confluence advantage: MU unique in combining 147% momentum with reasonable valuation support; consider 3-4% position

- Position thesis: AI infrastructure capex cycle validates demand; near-term consolidation likely but multi-year uptrend intact

Fintech Momentum (SOFI, HOOD) – High Risk

- Downside risks: Interest rate increases reducing lending profitability, retail investor activity normalization, regulatory crackdowns

- Catalyst risks: Loan portfolio credit deterioration, volatile crypto correlations, user acquisition cost inflation

- Mitigation: 2-3% positions; stops at -20%; quarterly review of credit metrics and user acquisition costs

- Position thesis: Structural fintech adoption trend supports multi-year thesis; near-term momentum likely continues

Growth/Momentum Outliers (CVNA, INSM, BE) – Very High Risk

- Downside risks: Cyclical industry challenges, company-specific execution risks, valuation expansion reversal

- Catalyst risks: Earnings disappointments, capital raises diluting shareholders, strategic pivots

- Mitigation: 1-2% maximum positions; aggressive stops at -25%; active monitoring of quarterly results

- Position thesis: Momentum-driven; valuation expansion risk is primary concern; tight risk management essential

Portfolio Construction Framework

Recommended allocation across analyses:

- Value candidates: 30-40% (emphasizing CMCSA/CHTR for liquidity and stability)

- Momentum candidates: 40-50% (with 50% of momentum allocation to semiconductor theme, particularly MU)

- Cash/defensive: 10-20% (for rebalancing opportunities and risk management)

Risk management rules:

- Maximum single position: 4% for mega-cap candidates (MU, CMCSA); 2-3% for mid-caps; 1-2% for cyclicals or high-beta momentum

- Sector caps: Technology/semiconductors maximum 20%; Media/Telecom maximum 12%; Energy maximum 8%

- Rebalancing triggers: Quarterly or when individual position gains exceed 50% (lock in gains, reduce exposure)

- Stop-loss discipline: Mechanical stops at -10 to -15% depending on volatility profile; no emotional overrides

- Catalyst monitoring: Quarterly earnings reviews, macroeconomic data releases (crude oil, interest rates, Fed policy)

Conclusion and Potential Opportunities

This comprehensive analysis identifies two contrasting but complementary investment strategies operating simultaneously in the market as of January 2026. The value screening analysis uncovers 7 large-cap stocks offering deep valuation support and dividend yields, suitable for investors prioritizing capital preservation and mean reversion. The momentum analysis identifies 10 stocks demonstrating sustained uptrends supported by structural tailwinds, appropriate for growth-oriented investors accepting volatility in exchange for capital appreciation.

The most compelling opportunity emerges from Micron Technology (MU), representing the unique confluence of value metrics and momentum characteristics. MU’s positioning within the semiconductor sector (benefiting from AI infrastructure capex), combined with reasonable forward valuations (8-9x P/E), validates both the value thesis (security of entry) and momentum narrative (growth catalysts).

For risk-averse investors, the telecommunications value cohort (CMCSA, CHTR) offers optimal risk-adjusted returns with defensive characteristics and reasonable upside. For growth-oriented investors, the semiconductor momentum cohort (WDC, SNDK with caution, LITE) provides leveraged exposure to AI capex cycles with validated technical strength.

All positions require active portfolio management, disciplined risk controls, and quarterly reassessment against macro conditions and sector-specific catalysts. The analyses provided herein establish quantitative frameworks for position sizing, stop-loss implementation, and rebalancing discipline essential for executing these strategies with acceptable risk-adjusted returns.

Key Sources

Value screening methodologies from Insider Monkey (March 2025), market data from Robinhood and Yahoo Finance (January 2026), technical analysis frameworks from GraniteShares and Real Investment Advice (2025), and momentum analysis from Morningstar (November 2025) and MarketBeat (January 2026).

Disclosures & Disclaimer

This analysis is for informational and educational purposes only and does not constitute financial, investment, or trading advice. All investing and trading involves substantial risk of loss, including potential loss of principal. Past performance does not guarantee future results. The author is not a registered financial advisor, investment professional, or licensed securities expert. Recipients should not act on this information without conducting independent research and consulting qualified financial professionals. This content was generated using artificial intelligence (AI) models and contains hypothetical data, simplified analyses, and forward-looking projections that may not reflect actual market conditions. Market data, technical indicators, and screening criteria are illustrative examples based on available information as of January 2026 and may contain inaccuracies or omissions. No representations are made regarding the accuracy, completeness, or timeliness of the information. Users assume all risk and liability for any trading decisions made based on this content.